DeFi Post-Crash: Unlocking Tomorrow's Breakthroughs

The State of DeFi: Navigating the Downturn

Okay, folks, let's talk DeFi. We've all seen the headlines, the charts dipped in red, the overall… yikes factor of the October crash still lingering in the air as we head into late 2025. The FalconX report paints a pretty stark picture: only a tiny handful of DeFi tokens are actually up this year. The overall sector? Down almost 40% this quarter. Ouch.

But here's the thing about crashes: they're not just about losses. They're about opportunity. It’s like a forest fire – devastating in the short term, but it clears the undergrowth, makes way for new growth, stronger growth. We’ve got to ask ourselves, is this DeFi dip a death knell, or a chance to load up on the future at a discount?

Decoding the DeFi Downturn

The report highlights some interesting divergences. Investors are flocking to "safer" names, the ones with buybacks or some kind of fundamental catalyst. HYPE and CAKE are mentioned, alongside MORPHO and SYRUP. It's a flight to quality, sure, but it also tells us something deeper. People still believe in DeFi. They're just being more selective, more discerning. They're not just throwing money at anything with "blockchain" in the name; they're looking for real value, real utility.

Market Maturation and Price Compression

And that's a good thing! That's the market maturing, shaking off the excesses of the last few years. We’re seeing price-to-sales multiples compress for DEXes, which, at first glance, might seem bad. But think about it: if the price is declining faster than the activity, that means you're getting more bang for your buck. You're buying into a growing business at a cheaper valuation. Isn’t that what every investor dreams of?

The Resilience of Lending Platforms

Lending and yield platforms are also seeing interesting dynamics. Even though their fees are down, their market caps haven't fallen as dramatically. This, the report suggests, is because investors see lending as "stickier" than trading. And it makes sense, doesn't it? Trading is speculative, emotional. Lending is fundamental, essential. It's the plumbing of the DeFi ecosystem, and it's likely to keep humming along even when the market gets choppy. In fact, lending might increase as people move into stablecoins and seek yield. It's like the old saying: "In a gold rush, sell shovels." Only in this case, the shovels are stablecoin loans.

Solana's Fundamentals and Utility

Now, I know what some of you are thinking: "Okay, Aris, that's a nice story, but what about Solana?" It’s true, Solana's had its ups and downs, its moments of congestion, its regulatory question marks. But look at the fundamentals. It's consistently processing over 1,000 transactions per second, with near-constant uptime. And SOL isn't just a speculative token; it's a utility token, used for transaction fees, staking, and ecosystem participation.

The Value of Utility in SOL

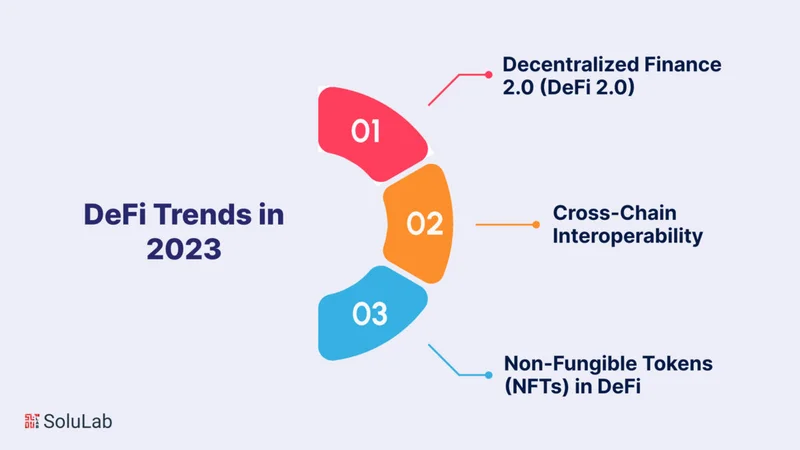

The Solana article mentions that "SOL functions primarily as a utility token for transaction fees and staking, not as a speculative instrument alone." This is crucial. It means that SOL's value is tied to the actual use of the Solana network, not just hype and speculation. And with DeFi and NFT activity continuing to expand on Solana, that utility is only going to increase.

Excitement for the Future

When I see metrics like 1.3 million monthly active addresses and transaction fees of just $0.00025, I get really excited. It feels like we’re on the cusp of something big, the kind of shift that could redraw the entire financial landscape. Is it a guarantee? Of course not. But the potential is undeniable.

A Chance to Rebuild

What this DeFi downturn offers is a chance to rebuild, to refocus, to build a more sustainable and resilient ecosystem. Like after a major earthquake, the foundations have been tested, the cracks are visible, and now we know where to reinforce. We know what works, and what doesn't.

The key, as always, is to do your own research. Don't just blindly follow the herd. Understand the technology, understand the tokenomics, and understand the risks. Look for projects with real utility, with strong communities, and with a long-term vision. And remember, this is a marathon, not a sprint.

The market can be a scary place right now, I know. But I always think back to what Eric Peters said: "When prices fall even as most traders/investors think they should rise, there must be a reason. We just don’t know it yet. Sooner or later, we will." Maybe the "reason" is simply that the market is giving us a chance to buy the future at a discount.

The Opportunity is Now.

DeFi is not dead. It's just getting started. According to a recent report, investor trends are shifting post-October crash, with a focus on safer DeFi assets. DeFi Token Performance & Investor Trends Post-October Crash

---

Your Punchline Here

A Future Worth Believing In.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

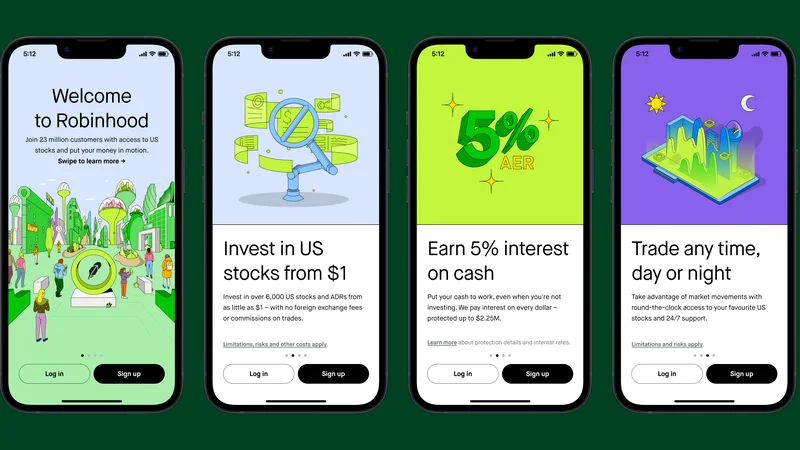

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Post-Crash: Unlocking Tomorrow's Breakthroughs

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- The Future of Tax: Decoding Your 2025-2026 Tax Brackets and Preparing for Tomorrow's Financial Landscape

- Dairy Queen Chapter 11: Unlocking the 'jackpot' of its next chapter

- Snowflake: The Data Platform, Stock Performance, and AI Strategy

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)